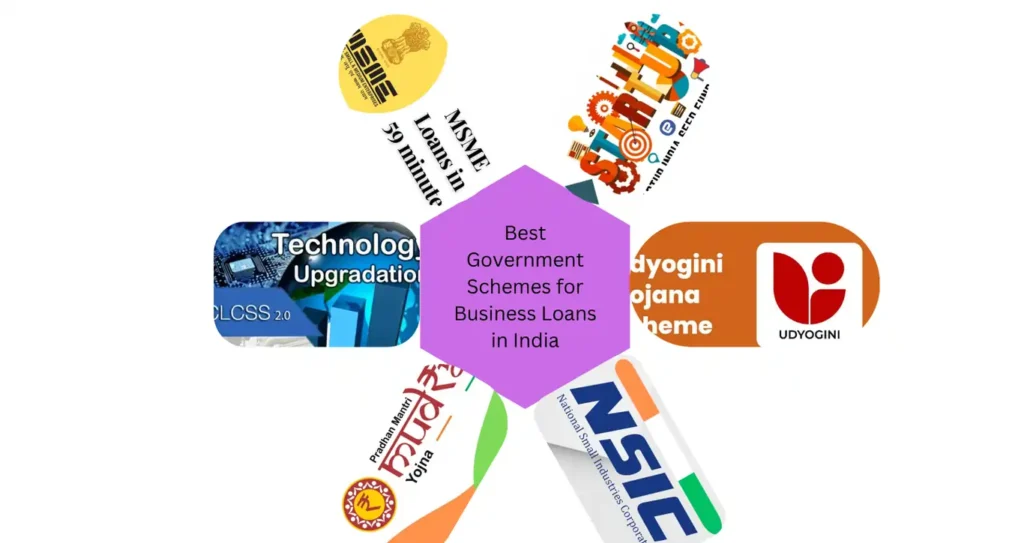

India offers several government-backed Business loan schemes to support entrepreneurs and businesses, aiming to boost economic growth and employment opportunities. India offers several government schemes to support businesses with low investment, helping entrepreneurs and small business owners access the funds they need to grow and succeed. Some of the best schemes include the MSME Loan Scheme in 59 Minutes, which provides loans up to Rs. 1 crore with quick approval; the Pradhan Mantri MUDRA Yojana (PMMY), offering collateral-free loans for micro-units and the Credit-Linked Capital Subsidy Scheme (CLCSS), which provides subsidies for technology upgradation. These schemes are designed to make it easier for small businesses to access capital, fostering economic growth and job creation across the country.

Also Read-Best Business to Start with Low Investment

Top Government Schemes for Business Loan in India

The Government of India has launched many strategic initiatives under various Government Enterprise Financing Programmes. These programmes include Government Business Financing, SME Financing and Start-up Specific Financing Programmes.

| Scheme Name | Purpose | Eligibility | Loan Amount | Interest Rate |

|---|---|---|---|---|

| MUDRA Loan | Funding small/micro businesses | MSMEs, entrepreneurs, and small vendors | Up to ₹10 Lakhs | Starts from 7.3% |

| Stand-Up India | Supporting SC/ST and women entrepreneurs | SC/ST or women entrepreneurs with a greenfield project | ₹10 Lakhs to ₹1 Crore | Varies by lender |

| CGTMSE (Credit Guarantee) | Collateral-free loans for MSMEs | New and existing MSMEs | Up to ₹2 Crore | Varies by lender |

| PSB Loans in 59 Minutes | Quick approval for MSME loans | MSMEs with GST, ITR, and bank details | ₹1 Lakh to ₹5 Crores | Starts from 8.5% |

| Startup India(Business loan Scheme ) | Supporting startups with funding | Startups recognized under the Startup India initiative | No specific limit (depends on proposal) | Varies based on funding |

These programmes aim to promote SME financing and provide critical capital for growth. They are a testament to the Government’s commitment towards promoting entrepreneurship in India.many notable schemes in india are the National Small Industries Corporation (NSIC), which offers financial aid for marketing, technology, and finance.

MSME Business Loan Scheme in 59 Minutes

The MSME Loan Scheme in 59 Minutes is an initiative by the Indian government to provide quick and easy access to financial assistance for Micro, Small, and Medium Enterprises (MSMEs).This scheme aims to simplify the loan application process, reduce the waiting period, and provide quick access to funds, helping MSMEs grow and expand their operations efficiently.

- Business loan Amount:- MSMEs can apply for loans up to Rs. 1 crore.

- Business loan Scheme Interest Rates:- Interest rates start at around 8%, but they may vary depending on the lender and the business’s credit rating.

- Eligibility:- The scheme is open to all MSMEs that are GST registered.

- Types of Loans:- Businesses can avail of both term loans for long-term needs (like purchasing machinery) and working capital loans for day-to-day operations.

- Quick Approval:- The entire loan approval process is digital and can be completed in just 59 minutes.

- Documentation:- The application process requires minimal documentation, making it easier for businesses to apply.

Pradhan Mantri MUDRA Yojana (PMMY)

The Pradhan Mantri MUDRA Yojana (PMMY) is a Business lone scheme launched by the Government of India to provide financial support to micro and small enterprises (MSEs) and non-corporate, non-farm small/micro enterprises. Providing loans up to ₹10 lakh in this scheme.

This scheme is implemented through various financial institutions including banks, NBFCs and MFIs. It has been helpful in promoting self-employment and generating sustainable livelihoods for individuals, especially in rural and semi-urban areas.

Mudra Yojana loans are classified into three types-

Children: Loans up to ₹50,000

Teens: Loans from ₹50,001 to ₹5 lakh

Youth: Loans from ₹5,01,000 to ₹10 lakh

National Small Industries Corporation (NSIC)

The National Small Industries Corporation (NSIC) is a Government of India enterprise under the Ministry of Micro, Small, and Medium Enterprises (MSME). Established in 1955, NSIC aims to promote, aid, and foster the growth of small enterprises in India.

- Single Point Registration Scheme (SPRS): NSIC enlists Micro and Small Enterprises (MSEs) under this scheme, making them eligible for benefits under the Public Procurement Policy for Micro and Small Enterprises.

- Technical Support: NSIC provides technical support through its Technical Services Centres (NTSCs) and a network of Testing and Inspection Centres (TICs) and Liaisoning Business Incubators (LBIs) spread across the country.

- Raw Material Assistance Scheme: NSIC helps MSMEs by financing the purchase of raw materials, both indigenous and imported, enabling them to focus on manufacturing quality products.

- Marketing Assistance: NSIC organizes trade fairs, exhibitions, and buyer-seller meets to help MSMEs showcase their products and services to potential buyers.

- Financial Assistance: NSIC offers various financial schemes to support MSMEs, including loans and subsidies for technology upgradation and marketing.

Credit Link Capital Subsidy Scheme Business Lone for Technology Upgradation

The National Small Industries Corporation (NSIC) offers various loan schemes to support MSMEs in India.These schemes aim to promote the growth and development of MSMEs, helping them overcome challenges and achieve sustainable growth.

- Raw Material Assistance Scheme: NSIC provides financial assistance to MSMEs for purchasing raw materials, both indigenous and imported, helping them focus on manufacturing quality products.

- Technical Support: NSIC offers technical support through its Technical Services Centres (NTSCs) and a network of Testing and Inspection Centres (TICs) and Liaisoning Business Incubators (LBIs) spread across the country.

- Marketing Assistance: NSIC organizes trade fairs, exhibitions, and buyer-seller meets to help MSMEs showcase their products and services to potential buyers.

- Financial Assistance: NSIC provides various financial schemes to support MSMEs, including loans and subsidies for technology upgradation and marketing.

- Single Point Registration Scheme (SPRS): MSMEs enlisted under this scheme are eligible for benefits under the Public Procurement Policy for Micro and Small Enterprises.

Udyogini Scheme

The Udyogini Scheme(Business loan Scheme) is an initiative by the Government of Karnataka aimed at empowering women by providing financial assistance for self-employment. Launched in 1997-1998 the scheme supports women in starting or expanding their own businesses, primarily in the trade and service sectors.

Startup India Seed Fund Scheme

The Startup India Seed Fund Scheme(SISFS) (Business loan Scheme ) is an initiative by the Government of India to provide financial assistance to early-stage startups. Launched in April 2021, the scheme aims to support startups in their initial stages.

- Financial Assistance:- Startups can receive up to ₹20 lakhs for proof of concept and prototype development, and up to ₹50 lakhs for market entry and commercialization.

- Eligibility:- Recognized startups incorporated less than 2 years ago.

- Sector:- Open to startups from any sector

FAQ’s

What is the MSME Business loan Scheme in 59 Minutes?

The MSME Business loan Scheme in 59 Minutes is a government initiative that provides quick and easy access to loans up to ₹1 crore for Micro, Small, and Medium Enterprises (MSMEs). The entire loan approval process is digital and can be completed in just 59 minutes.

What are the categories under the Pradhan Mantri MUDRA Yojana (PMMY)?

PMMY Business loan offers under three categories:

Shishu: Loans up to ₹50,000

Kishor: Loans from ₹50,001 to ₹5 lakh

Tarun: Loans from ₹5,01,000 to ₹10 lakh

Who is eligible for the Udyogini Scheme?

Women aged 18 to 55 years with a family income below ₹2 lakh per year are eligible. There are no income limits for widowed or disabled women.

What is the Business loan Scheme Startup India Seed Fund Scheme (SISFS)?

AIM fosters innovation and entrepreneurship through programs like Atal Tinkering Labs (ATLs) in schools, Atal Incubation Centres (AICs) for startups, and Atal New India Challenges (ANIC) for technology-based innovations.

What does the National Small Industries Corporation (NSIC) Business loan offer?

NSIC provides financial assistance for purchasing raw materials, technical support, marketing assistance, and various financial schemes to support MSMEs.

Good